Getting to grips with ESRS double materiality

The Double Materiality Assessment is at the core of the incoming European Sustainability Reporting Standards (ESRS)– the disclosures required under the EU’s Corporate Sustainability Reporting Directive (CSRD) – and is becoming the gold standard regulators are pushing to adopt to assess a company’s ESG performance. But what does “double materiality” mean and how does it differ from the existing single (financial) materiality?

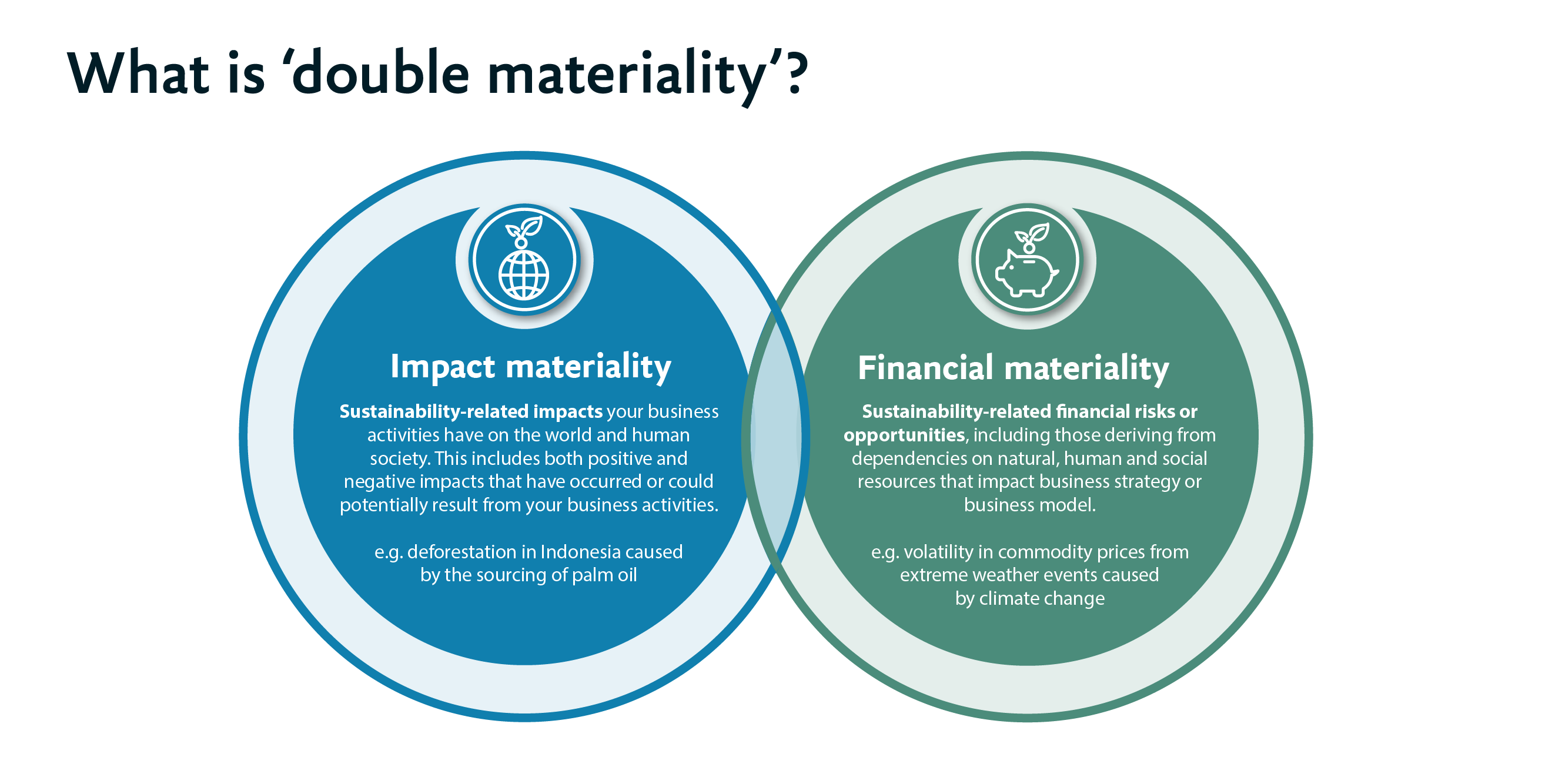

Double materiality attempts to move past sole consideration of a company’s sustainability-linked financial risks and opportunities (outside-in), to also include the impact the company’s actions have on the world and human society that don’t directly impact financial performance (inside-out). For a global retailer this might mean moving from just considering the risk of a global carbon tax (single-materiality) to also considering the impact on the natural world and local communities of deforestation in Malaysia caused by sourcing of palm oil (double-materiality).

So, what does double materiality entail in practice, what is it used for, and how can you get your preparations on track?

It is likely that you already report on business risks, dependencies and opportunities affecting your financial performance, e.g. supply chain disruption from climate-linked disasters and cybersecurity attacks.

Now, imagine you would also need to look outside-in at your impact on society and the environment. And this wouldn’t just be factors that might affect your financial performance such as the large fines and penalties associated with a chemical spill or other damaging compliance breach. It would also cover the cumulative and long-term impacts that may fall a long way below the standard financial materiality threshold, but could still have a material impact on those affected.

This combination of financial materiality and impact materiality is double materiality in a nutshell.

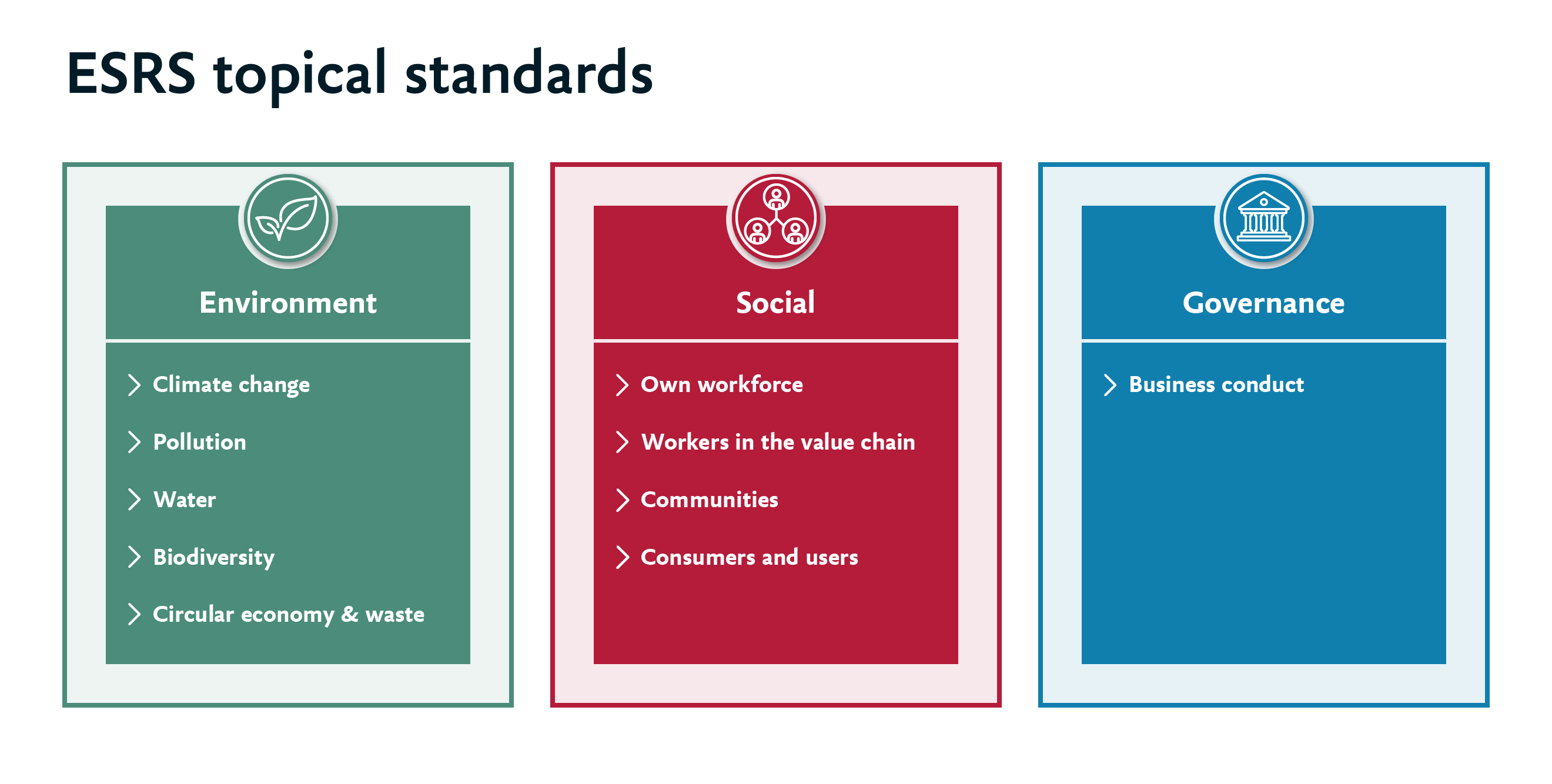

ESRS asks you to conduct an assessment of your sustainability topics using the concept of double materiality to determine which disclosures and datapoints you need to report on.

So how do you conduct a double materiality assessment (DMA) in practice?

Four steps to kick-start your DMA

The good news is that you still have time to prepare, especially if you’re one of the UK, US and other non-EU-based businesses that would be due to file your first report in 2026 or 2027. Remember, ESRS doesn’t only apply to businesses listed in the EU, if you’ve got significant operations in the EU you will soon be in scope too.

But you do need to get started as soon as possible as there may be a significant amount of scoping, stakeholder engagement and data gathering needed to get it right.

In Under the spotlight: Gearing up for ESRS, we look at how to determine your strategic ambitions for ESRS and ensure sufficient top-level leadership and resourcing. Focusing on double materiality assessment specifically, four starting points stand out.

Map your business operations and value chain from sourcing to end of life. Identify the key stakeholders within your value chain who can help spot key sustainability issues across the value chain. Depending on the type of business this may mean identifying both internal stakeholders (i.e. relevant business functions and SMEs) and external stakeholders (e.g. shareholders, suppliers, consumers).

Trying to create a long-list of all the possible sustainability linked impacts and financial risks can feel like a pretty dauting task – after all, every action and decision you take could be seen to have an impact on the world. The key to creating a manageable long list is to work with stakeholders to assess what they collectively see as the important sustainability issues across your operations and value chain. This might include reviewing shareholder questions, analysing consumer trends, interviewing suppliers and focus groups with key SMEs in the business.

Say you make canned drinks, for example. If so, you’d have to chart the material impacts, risks and opportunities right through from labour conditions in the mines where the metals are extracted, resources used in smelting and pollution in surrounding communities through to production, impact on the health of drinkers and how efficiently the cans are recycled and reused.

The next step is creating a test for what is material and what this means for your business. This will vary for each business and depend on a number of factors, e.g. the scale of your operations.

Impact materiality focuses on the severity and likelihood of the social and environmental impact, though there is no clear-cut definition. So it’s important to determine what is material in the context of your business and its value chain.

Whilst much of this may appear to be novel, most businesses already have a good handle on their principal financial risks and opportunities are and have a good sense of where they major material impacts lie. Some data sources and assessments may already be in place for other mandatory or voluntary disclosures, e.g. GRI. You can also reach out to industry groups and peers for advice on best practice and areas where you can collaborate. Everyone is in the same boat, so partnership is a fast and effective way forward.

Let’s talk

We are currently helping several of our large multinational clients develop and run their double materiality assessment as well as helping them deliver their CSRD disclosures in time for filing. Talk to us if you’d like to know more.